Managing finances can be challenging for businesses. Online accounting software simplifies this task.

In today’s fast-paced world, keeping track of finances is crucial. Online accounting software offers a practical solution. It helps businesses manage their accounts efficiently. From tracking expenses to generating invoices, these tools make financial management simpler. They save time and reduce errors.

This software is ideal for small businesses, startups, and even large corporations. It allows users to access financial data anytime, anywhere. This flexibility is a game-changer for busy entrepreneurs. Online accounting software also ensures data security with robust encryption. In this blog post, we will explore the benefits, features, and top options available. Stay tuned to learn how this software can improve your financial management.

Credit: www.xero.com

Introduction To Online Accounting Software

Managing finances can be a complex task for businesses. Online accounting software simplifies this process. It helps businesses keep track of finances efficiently. Let’s explore what online accounting software is and its importance.

What Is Online Accounting Software?

Online accounting software is a digital tool. It helps manage financial transactions over the internet. This software stores data on the cloud. Users can access it from anywhere with an internet connection. It offers features like invoicing, payroll, and tax calculations.

Importance Of Streamlining Finances

Streamlining finances is crucial for business success. Online accounting software plays a key role in this process.

- Time-Saving: Automates repetitive tasks like invoicing and payroll.

- Accuracy: Reduces human errors in financial calculations.

- Accessibility: Access financial data anytime, anywhere.

- Cost-Effective: Lowers the need for physical storage and paperwork.

- Real-Time Updates: Provides up-to-date financial information.

These features make online accounting software essential for businesses of all sizes. It helps in managing finances efficiently and effectively.

| Feature | Benefit |

|---|---|

| Automation | Saves time on repetitive tasks |

| Cloud Storage | Access data from anywhere |

| Real-Time Updates | Up-to-date financial information |

| Error Reduction | Improves accuracy in calculations |

Online accounting software is a valuable tool for businesses. It ensures efficient financial management and better decision-making.

Key Features

Online accounting software has many features to help manage business finances. These features help save time and reduce errors. Below are some key features that make online accounting software a valuable tool.

Automated Bookkeeping

Automated bookkeeping is a major feature of online accounting software. It records transactions automatically. This reduces the chance of mistakes. You do not need to enter data manually. This saves time and effort. The software updates your records in real-time. This keeps your financial data accurate and current.

Expense Tracking

Expense tracking is crucial for managing business costs. Online accounting software tracks expenses easily. You can categorize expenses. This helps you see where your money goes. The software can link to your bank accounts. This makes tracking expenses automatic. You can also scan and save receipts. This keeps all expense records in one place.

Invoicing And Billing

Invoicing and billing are key parts of any business. Online accounting software makes this process easy. You can create and send invoices quickly. The software can set up recurring invoices. This saves time for regular clients. You can also track payments. This helps you see which invoices are paid and which are overdue. Keeping track of invoices and billing helps ensure timely payments.

Benefits Of Online Accounting Software

Online accounting software has many benefits for businesses. It helps save time, ensures accuracy, and provides easy access to financial data. Let’s explore these advantages in detail.

Time-saving

Online accounting software speeds up accounting tasks. Automated processes reduce the time spent on manual data entry. Recurring invoices can be set up to save even more time. With real-time updates, you no longer wait for monthly reports. This software also generates financial statements quickly.

Accuracy And Reliability

Human errors are common in manual accounting. Online software minimizes these errors. It performs automatic calculations and checks for inconsistencies. Data validation ensures that entries are accurate. Reliable backups protect your data from loss. This means you can trust the software with your financial information.

Accessibility

Access your financial data from anywhere with online software. All you need is an internet connection. This is ideal for remote work or travel. Multiple users can access the system at the same time. This enhances collaboration within your team. Mobile apps offer the same features as desktop versions.

Below is a table summarizing the benefits:

| Benefit | Description |

|---|---|

| Time-Saving | Automated processes and real-time updates |

| Accuracy and Reliability | Minimized errors and reliable backups |

| Accessibility | Access from anywhere with internet |

Online accounting software is a smart choice for modern businesses. It saves time, ensures accuracy, and offers great accessibility. Simplify your accounting tasks with this powerful tool.

Credit: akaunting.com

Choosing The Right Software

Choosing the right online accounting software can be a crucial decision for your business. The right software can streamline your financial processes, save time, and reduce errors. To make the best choice, consider your specific needs, compare popular options, and read user reviews. This guide will help you navigate these important steps.

Evaluating Your Needs

Start by evaluating your business requirements. Ask yourself the following questions:

- What is the size of your business?

- Do you need software for payroll management?

- Is invoicing a critical feature for you?

- Do you require multi-currency support?

- Will multiple users access the software?

List these needs clearly. This helps in narrowing down your options. Remember, not all software will have every feature you need. Prioritize the most important ones.

Comparing Popular Options

Once you’ve identified your needs, compare popular online accounting software options. Here’s a table to help:

| Software | Key Features | Pricing |

|---|---|---|

| QuickBooks Online | Invoicing, payroll, expense tracking, multi-currency | Starts at $25/month |

| Xero | Bank reconciliation, invoicing, inventory management | Starts at $20/month |

| FreshBooks | Invoicing, time tracking, expense management | Starts at $15/month |

Compare features and prices. This comparison will help you see which software meets your needs and fits your budget.

Reading User Reviews

User reviews provide real-life insights. Read reviews on trusted sites like Capterra, Trustpilot, and G2 Crowd. Look for comments on:

- Ease of use

- Customer support

- Reliability

- Feature satisfaction

- Value for money

Pay attention to both positive and negative feedback. Reviews can reveal common issues and strengths of the software. This information is invaluable in making an informed decision.

Setting Up Your Account

Getting started with online accounting software can seem daunting. But it doesn’t have to be. Setting up your account is a straightforward process. Follow these steps to get your software up and running quickly.

Initial Setup

First, create your account. Use your email address and a strong password. Verify your email to complete the registration process. After this, you will be guided through a setup wizard. This will ask for basic information like your business name and address. Fill these details accurately. This ensures your invoices and reports are correct.

Customizing Preferences

Once your account is set up, customize your preferences. Go to the settings menu. Here, you can adjust options to suit your business needs. Change the currency, set your fiscal year, and select your tax settings. Customizing these preferences helps tailor the software to your business.

Importing Data

Next, import your existing data. This can include customer lists, vendor information, and previous transactions. Most online accounting software allows you to upload CSV files. Follow the software’s instructions to map your data correctly. This step is crucial for a seamless transition. It ensures all your past records are in one place.

Integrating With Other Tools

Integrating with other tools is a key feature of online accounting software. It simplifies your workflow and enhances productivity. Seamless integration ensures your financial data stays accurate and up-to-date. This section explores how online accounting software syncs with various tools to streamline your business operations.

Syncing With Bank Accounts

Online accounting software can sync directly with your bank accounts. This feature automates the process of importing transactions. It reduces manual data entry and minimizes errors. Your bank transactions are updated in real-time, providing a clear financial picture. You can easily reconcile your accounts and keep your books accurate.

Connecting With Payment Gateways

Integrating with payment gateways is another valuable feature. Online accounting software connects with popular payment processors. This allows you to accept online payments seamlessly. Payments are automatically recorded in your accounting system. It saves time and ensures your records are always current. This integration also helps in tracking sales and managing cash flow efficiently.

Linking To Payroll Services

Linking to payroll services is crucial for businesses with employees. Online accounting software can integrate with payroll providers. This feature automates payroll processing and tax calculations. Employee salaries and deductions are accurately tracked. It ensures compliance with tax regulations and reduces the risk of errors. Your payroll data is synchronized with your accounting records, keeping everything in one place.

Security And Data Protection

Choosing the right online accounting software involves ensuring the security and protection of your financial data. This is a critical aspect because sensitive information must remain safe. Let’s explore some key elements that contribute to the security and data protection of online accounting software.

Encryption Standards

One of the primary ways to secure data is through encryption. The best online accounting software uses advanced encryption standards (AES). This means that your data is turned into code, making it unreadable to unauthorized users.

For instance, 256-bit encryption is common. It ensures a high level of security. Think of it as a lock with a combination of 256 characters. It’s nearly impossible to crack. This helps protect your data from hackers and unauthorized access.

Regular Backups

Regular backups are essential for data protection. Good online accounting software performs automatic backups. This ensures that your data is never lost, even if there’s a technical issue.

- Daily backups keep your information up-to-date.

- Weekly backups provide additional security.

- Monthly backups add another layer of protection.

These backups are often stored in secure, remote locations. This means that even in case of hardware failure, your data remains safe and accessible.

User Permissions

Controlling who has access to your data is crucial. Online accounting software allows you to set user permissions. This means you can decide who sees what information.

For example, you might allow an accountant to view and edit financial records. Meanwhile, a salesperson might only access sales data. This control helps to protect sensitive information.

Setting user permissions is simple. It usually involves checking boxes or selecting options from a menu. This way, you can easily manage access levels and ensure that only authorized users handle your financial data.

Maximizing Efficiency

Maximizing efficiency with online accounting software can save time and reduce errors. By using the right tools and strategies, businesses can streamline their accounting processes. This can lead to increased productivity and better financial management. Here are some key ways to maximize efficiency with online accounting software:

Utilizing Automation

Automation can handle repetitive tasks, freeing up valuable time. For example, automated invoicing ensures timely billing. This reduces the risk of human error. Automated expense tracking keeps your records accurate. This helps in maintaining up-to-date financial data.

Other automation features include:

- Bank reconciliation

- Payroll processing

- Tax calculations

Regularly Updating Software

Regular software updates are crucial. They provide the latest features and security patches. This helps protect sensitive financial data. Updated software also ensures compatibility with other tools.

Benefits of regular updates:

| Benefit | Description |

|---|---|

| Security | Protects against vulnerabilities |

| New Features | Access to latest functionalities |

| Performance | Improved speed and efficiency |

Training Your Team

Proper training is essential for maximizing efficiency. Ensure your team knows how to use the software. Provide regular training sessions. This keeps everyone updated on new features. Encourage your team to ask questions and seek help when needed.

Effective training includes:

- Initial onboarding sessions

- Regular refresher courses

- Access to online tutorials and resources

A well-trained team can use the software to its full potential. This leads to better financial management and increased productivity.

Troubleshooting Common Issues

Online accounting software offers many benefits. But users may face some common issues. Troubleshooting these issues can save time and reduce stress. This section focuses on three main problems users often encounter: login problems, data sync issues, and technical support. Let’s dive into each one.

Login Problems

Users often face login problems. Forgotten passwords are a common issue. Resetting the password usually solves this. Sometimes, users enter incorrect usernames. Double-check the username to ensure accuracy. Browser issues can also cause login problems. Clear the browser cache and cookies. This often resolves login difficulties.

Data Sync Issues

Data sync issues can disrupt workflow. Ensure a stable internet connection. Unstable connections often cause sync problems. Update the software regularly. Outdated versions may not sync correctly. Check if the server is down. Server downtime can affect data syncing. Verify settings and permissions. Incorrect settings can block data sync.

Technical Support

Technical support is crucial for resolving issues. Contact support for complex problems. Provide detailed information about the issue. This helps in quicker resolution. Use live chat or email for immediate assistance. Many software providers offer 24/7 support. Check the FAQ section. Many common issues are addressed there. Join user forums. Other users may have faced similar problems. Sharing solutions can be helpful.

Future Trends

Online accounting software is constantly evolving. Future trends in this field promise exciting changes. These advancements aim to make financial management easier and more efficient.

Ai And Machine Learning

AI and machine learning are transforming online accounting. These technologies help automate repetitive tasks. They also improve accuracy in data entry. AI can predict financial trends. This helps businesses make informed decisions. Machine learning can detect anomalies and fraud. This ensures better security for financial data.

Blockchain Integration

Blockchain offers transparency and security. Integrating blockchain with online accounting software enhances trust. Transactions become more secure and traceable. Blockchain reduces the risk of fraud. It provides a clear audit trail. This can simplify compliance with regulations. Blockchain integration ensures that data is tamper-proof.

Mobile Accounting Solutions

Mobile accounting solutions are gaining popularity. They offer flexibility and convenience. Users can access financial data from anywhere. Mobile apps provide real-time updates. This allows for quick decision-making. Small businesses benefit from mobile accounting. It reduces the need for physical paperwork. Mobile solutions also support remote work. This is vital in today’s digital age.

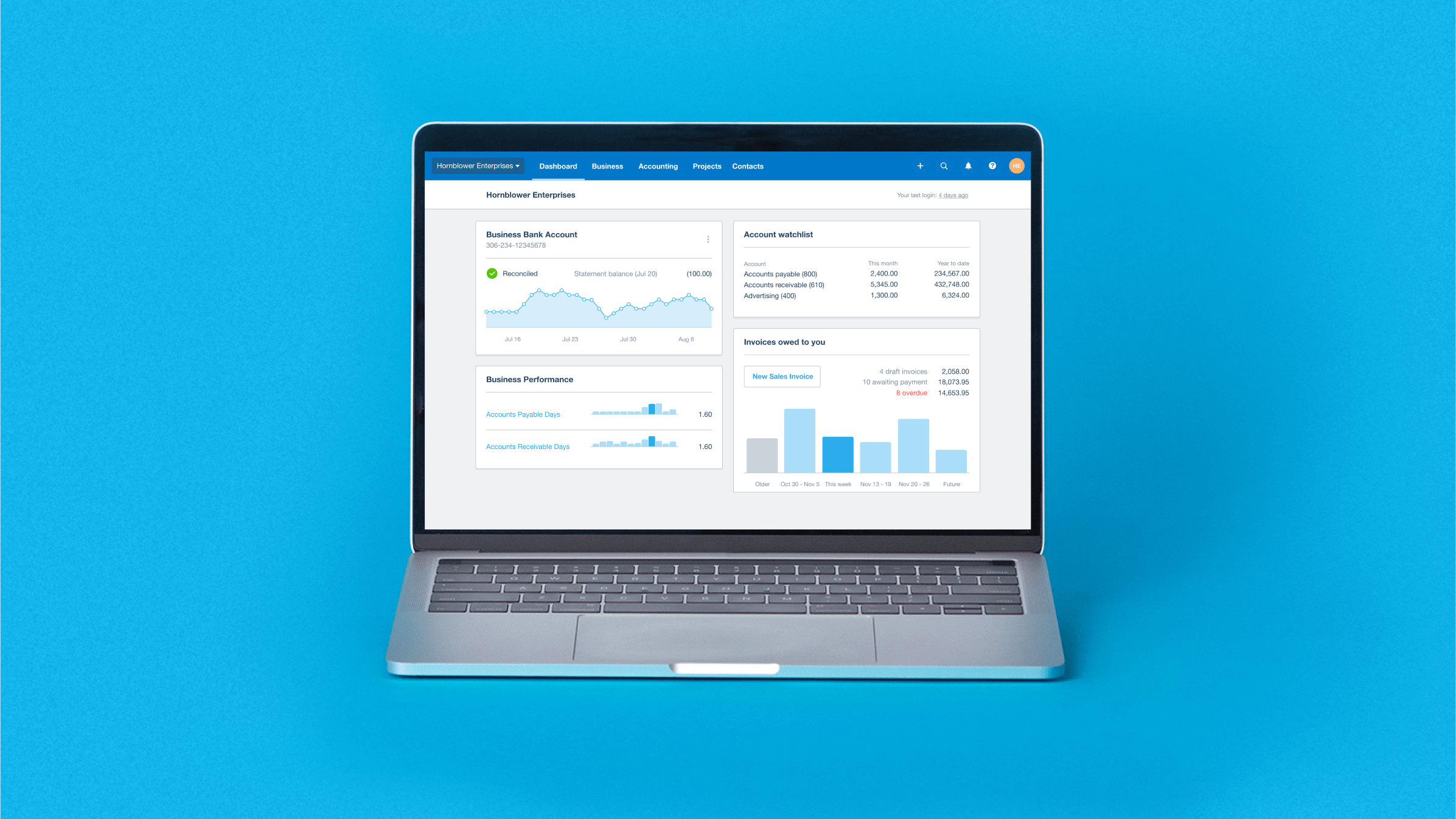

Credit: quickbooks.intuit.com

Frequently Asked Questions

What Is Online Accounting Software?

Online accounting software is a digital tool that helps businesses manage their financial transactions and records. It allows for real-time access to financial data, making it easier to track expenses, generate invoices, and monitor cash flow. This software is accessible from any device with internet connectivity.

How Does Online Accounting Software Work?

Online accounting software works by storing financial data on cloud servers. Users can input, track, and analyze financial transactions through a web-based interface. The software automates tasks like invoicing, payroll, and tax calculations. It also provides real-time reporting and analytics to help manage finances efficiently.

What Are The Benefits Of Online Accounting Software?

The benefits of online accounting software include real-time financial tracking, automated processes, and increased accuracy. It also offers remote access, making it convenient for users to manage finances from anywhere. Additionally, it provides secure data storage and reduces the risk of errors compared to manual accounting.

Is Online Accounting Software Secure?

Yes, online accounting software is secure. It uses encryption and other security measures to protect your financial data. Regular updates and backups ensure data integrity and protection against cyber threats. Always choose reputable software providers to ensure maximum security for your financial information.

Conclusion

Online accounting software simplifies managing finances. It saves time and reduces errors. Easy for small businesses to use. Accessible anywhere with an internet connection. Increases efficiency and helps with tax compliance. Choose the right software for your needs. Start streamlining your accounting today.

Your business will thank you.