Choosing the right accounting software is crucial for any business. Xero and QuickBooks are two popular options.

Both offer unique features and benefits. Comparing Xero and QuickBooks helps you understand which suits your needs best. Accounting software can make managing finances easier and more efficient. Xero and QuickBooks each have their strengths. One might be better for small businesses, while the other could benefit larger ones.

Understanding their differences can save you time and money. In this post, we will explore the key features of both platforms. This will help you make an informed decision. Stay tuned to find out which one is right for your business.

Credit: pilot.com

User Interface

The user interface is a crucial aspect of any accounting software. It determines how easily users can perform tasks and navigate through the platform. In this section, we will explore the user interface of Xero and QuickBooks. We will focus on Ease of Use and Navigation and Design.

Ease Of Use

Both Xero and QuickBooks aim to provide a user-friendly experience. QuickBooks offers a straightforward setup process. Users can start managing finances quickly. Xero, on the other hand, provides a clean and minimalistic interface. It helps users focus on essential tasks without distractions.

QuickBooks has a more guided approach. It offers tutorials and step-by-step instructions. This makes it easier for beginners. Xero allows more customization. Users can tailor the dashboard to fit their needs. Both platforms strive to be intuitive. Yet, they have different approaches to user guidance.

Navigation And Design

Navigation is key to any software. QuickBooks has a traditional layout. It uses a sidebar menu for main tasks. Users can easily switch between sections. The design is familiar to those with accounting experience.

Xero takes a modern approach. It uses a dashboard-centric design. Users can access most features from the dashboard. The layout is clean and uncluttered. This can be less intimidating for new users.

Here is a comparison table for better understanding:

| Feature | QuickBooks | Xero |

|---|---|---|

| Setup Process | Guided, easy for beginners | Simple, minimalistic |

| Navigation | Sidebar menu | Dashboard-centric |

| Design | Traditional | Modern |

| Customization | Limited | Highly customizable |

Both Xero and QuickBooks excel in different areas. QuickBooks is great for those new to accounting software. Xero offers flexibility and a modern look. Choosing the right one depends on user preference. Consider what features are most important for your business.

Pricing Plans

Choosing between Xero and QuickBooks can be challenging. Understanding their pricing plans is crucial. Both offer various subscription tiers tailored to different business needs. Let’s delve into the details.

Subscription Tiers

Both Xero and QuickBooks offer multiple subscription tiers. Each tier caters to different business sizes and requirements.

| Subscription Tier | Xero | QuickBooks |

|---|---|---|

| Basic | Early | Simple Start |

| Intermediate | Growing | Essentials |

| Advanced | Established | Plus |

Each tier offers specific features. The Basic tier is ideal for small businesses. The Intermediate tier suits growing businesses. The Advanced tier is perfect for established enterprises.

Cost Comparison

Comparing the costs of Xero and QuickBooks helps in making an informed decision.

- Xero Early: $12/month

- Xero Growing: $34/month

- Xero Established: $65/month

- QuickBooks Simple Start: $25/month

- QuickBooks Essentials: $50/month

- QuickBooks Plus: $80/month

As seen, Xero offers a cheaper starting plan compared to QuickBooks. QuickBooks, however, provides more features in its higher tiers.

Choosing the right plan depends on your business needs. Evaluate the features and costs carefully before deciding.

Features And Functionalities

Choosing between Xero and QuickBooks can be challenging. Both offer robust features and functionalities. Let’s break down their core features and advanced tools.

Core Features

Xero and QuickBooks both provide essential accounting features. These include invoicing, expense tracking, and bank reconciliation. Xero offers unlimited users in all its plans. QuickBooks limits the number of users based on the plan.

Both platforms support payroll management. They allow for easy integration with third-party apps. Xero’s interface is user-friendly and visually appealing. QuickBooks offers a more traditional design. Yet, it’s intuitive and easy to navigate.

Advanced Tools

Xero provides robust reporting capabilities. It allows for in-depth financial analysis. Users can customize reports to meet their needs. QuickBooks offers advanced inventory management. It is ideal for businesses with complex inventory needs.

Xero includes a project management tool. This tool helps track time and costs. QuickBooks offers a similar feature in its higher-tier plans. Both platforms support multi-currency transactions. Xero includes this in all plans. QuickBooks reserves it for higher-tier plans.

Both offer mobile apps for on-the-go access. They ensure you can manage finances from anywhere. Xero and QuickBooks both provide strong security features. These include encryption and two-factor authentication.

Integration Capabilities

When comparing Xero and QuickBooks, integration capabilities play a crucial role. Both platforms offer extensive options to connect with third-party apps and provide robust API support. These features enhance their usability and functionality for businesses of all sizes. Let’s explore their integration capabilities in detail.

Third-party Apps

Xero integrates with over 800 third-party apps. This includes popular tools for CRM, payroll, and e-commerce. You can sync Xero with platforms like Shopify, PayPal, and Stripe. This wide range of integrations helps automate many tasks. It also ensures that your business processes are streamlined.

QuickBooks also offers a large selection of third-party integrations. You can connect QuickBooks with over 650 apps. These include tools for inventory management, time tracking, and project management. Some popular integrations are with TSheets, Bill.com, and Square. These integrations help improve your workflow and save time.

Api Support

Xero provides a powerful API that allows developers to build custom integrations. The Xero API is well-documented and easy to use. It supports numerous functionalities. This includes creating invoices, managing contacts, and tracking expenses. Many businesses leverage the Xero API to tailor their accounting system to their specific needs.

QuickBooks also offers strong API support. The QuickBooks API is robust and versatile. It allows developers to create custom solutions. These solutions can range from simple data syncs to complex financial reporting tools. The API documentation is comprehensive. This makes it easier for developers to work with.

Customer Support

When choosing accounting software, customer support is a key factor. Both Xero and QuickBooks offer various support options. Understanding these can help you decide which is right for your business.

Support Channels

Both Xero and QuickBooks provide multiple support channels. These include:

- Phone

- Live chat

- Community forums

- Help articles

QuickBooks also offers a callback service. This is helpful if you prefer speaking to a representative.

Here is a quick comparison:

| Support Channel | Xero | QuickBooks |

|---|---|---|

| Yes | Yes | |

| Phone | No | Yes |

| Live Chat | Yes | Yes |

| Community Forums | Yes | Yes |

| Help Articles | Yes | Yes |

| Callback Service | No | Yes |

Response Time

Response time is vital for resolving issues quickly. Xero’s email support typically replies within 24 hours. Their live chat is faster, often within minutes.

QuickBooks’ phone support usually has short wait times. Their live chat is also quick, often responding within minutes. QuickBooks’ callback service is convenient, reducing wait times further.

For those who prefer self-help, both platforms have extensive knowledge bases. These include articles and guides. Many find answers without contacting support.

Choosing the right software depends on your support preferences. Evaluate the channels and response times to make an informed choice.

Credit: pilot.com

Security Measures

In today’s digital world, the security of financial data is crucial. Both Xero and QuickBooks offer strong security features. This section will explore the security measures of both platforms, focusing on data encryption and backup solutions.

Data Encryption

Xero uses industry-standard encryption to protect user data. It employs 256-bit SSL encryption to secure data during transmission. This level of encryption is used by banks and government agencies. It ensures that data is safe from hackers.

QuickBooks also uses 256-bit SSL encryption. This protects data while it is being transmitted between users and Intuit’s servers. QuickBooks further enhances security with two-factor authentication (2FA). This adds an extra layer of protection by requiring a second form of identification.

Backup Solutions

Xero provides automatic backups. These backups ensure that user data is always safe and secure. Xero’s data centers are located in multiple geographic regions. This redundancy ensures that data is safe even during regional outages.

QuickBooks also offers automatic backups. It stores backups in secure, off-site locations. QuickBooks’ backup solutions allow users to restore data from any point in time. This ensures that users can recover their data in the event of an error or data loss.

| Feature | Xero | QuickBooks |

|---|---|---|

| Data Encryption | 256-bit SSL | 256-bit SSL |

| Backup Solutions | Automatic, multiple regions | Automatic, off-site |

| Additional Security | Secure data centers | Two-factor authentication |

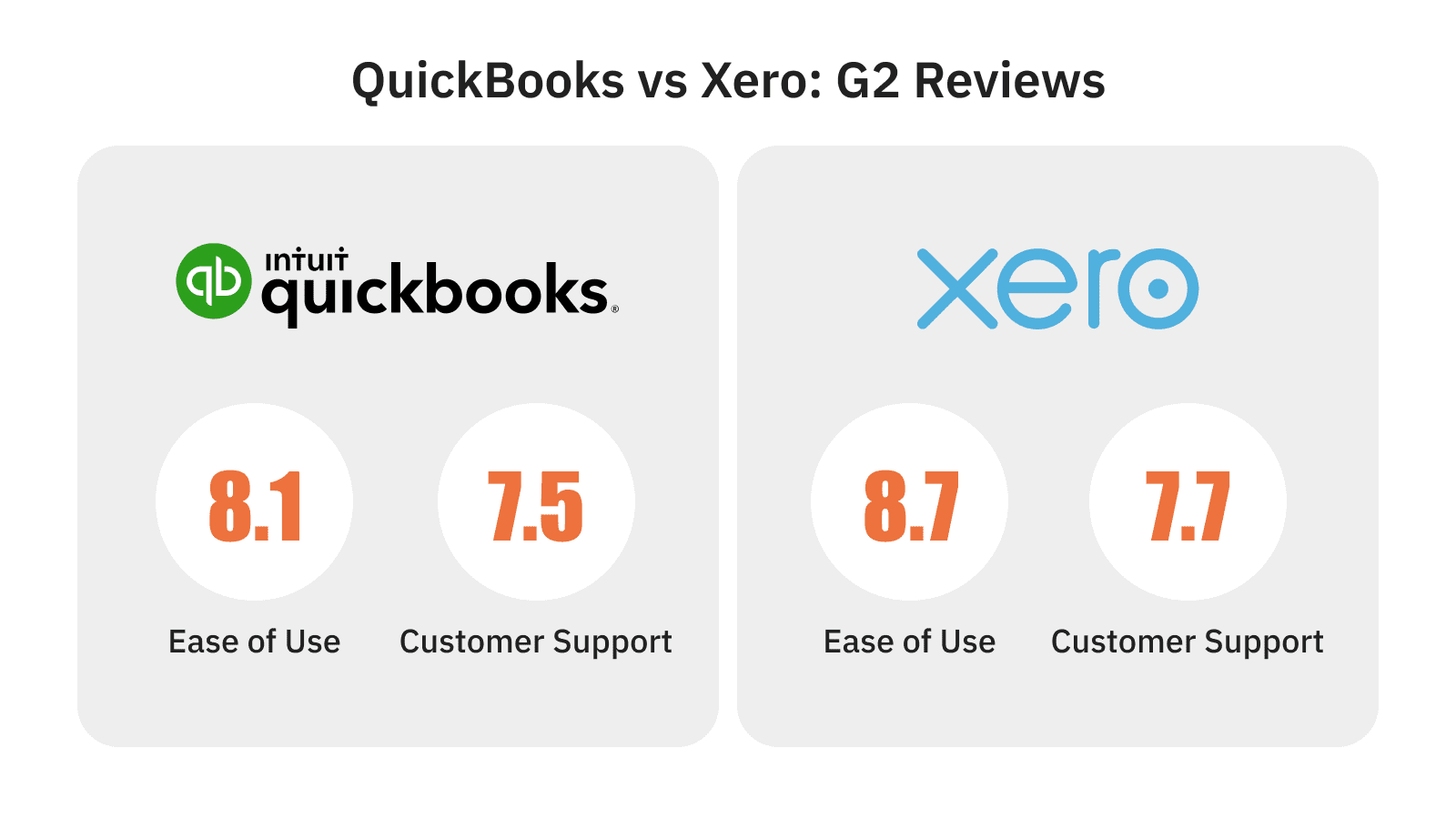

User Reviews And Feedback

Choosing the right accounting software can be challenging. User reviews and feedback are critical when deciding between Xero and QuickBooks. Let’s dive into what real users have to say about these popular tools.

Customer Satisfaction

Overall, both Xero and QuickBooks receive positive feedback. Users appreciate the ease of use and robust features. Here are some highlights:

- Xero: Many users love its clean interface. They find it easy to navigate.

- QuickBooks: Users often praise its comprehensive features. They also appreciate its integration capabilities.

In general, customers report high satisfaction with both platforms. They find them reliable and effective for managing finances.

Common Complaints

Despite the positive reviews, there are some common complaints. Here’s a quick look at the issues users face:

| Software | Common Complaints |

|---|---|

| Xero |

|

| QuickBooks |

|

Understanding these complaints can help you make a more informed decision. Balancing the positives and negatives is essential.

Credit: www.chargebee.com

Frequently Asked Questions

What Is The Main Difference Between Xero And Quickbooks?

Xero is cloud-based, focusing on seamless integration and real-time updates. QuickBooks offers both cloud and desktop versions, with robust features for small businesses.

Which Is Better For Small Businesses, Xero Or Quickbooks?

QuickBooks is often preferred by small businesses due to its comprehensive features and ease of use. Xero is also popular for its intuitive interface and integration capabilities.

Does Xero Integrate With Other Business Apps?

Yes, Xero integrates with over 800 business apps, including CRM, inventory management, and payment processing tools. This makes it highly versatile.

Is Quickbooks Easier To Use Than Xero?

QuickBooks is known for its user-friendly interface and extensive support resources. Xero is also easy to use but may require some initial learning.

Conclusion

Choosing between Xero and QuickBooks depends on your business needs. Both offer strong accounting features. Xero is great for small businesses. QuickBooks suits those needing advanced options. Consider your budget, user interface, and specific tools. Try both if unsure. This helps you find the best fit.

Remember, the right software saves time and money. Make an informed decision for your business.