In today’s fast-paced business world, managing finances efficiently is crucial. Xero offers a robust solution tailored for small businesses.

Running a small business is no easy task. Every penny counts, and managing finances can be overwhelming. Xero steps in as a powerful tool that streamlines accounting tasks. It simplifies invoicing, payroll, and expense tracking. Designed with small business owners in mind, Xero makes financial management less stressful.

Whether you’re tech-savvy or not, its user-friendly interface is easy to navigate. By automating many accounting processes, Xero allows you to focus more on growing your business. This blog will explore how Xero can benefit small businesses.

Introduction To Xero

Small businesses often struggle with managing their finances efficiently. This is where Xero comes into play. Xero is an online accounting software that helps small business owners manage their finances seamlessly. It simplifies the process, making it easier for businesses to stay on top of their financial health.

What Is Xero?

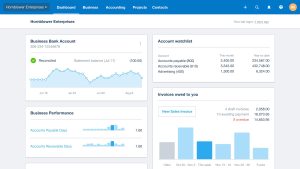

Xero is a cloud-based accounting software. It was designed with small businesses in mind. It offers a wide range of features. These features include invoicing, expense tracking, and bank reconciliation. Xero also provides real-time financial reporting. This helps businesses keep track of their financial performance.

Benefits For Small Businesses

Xero offers many benefits for small businesses. First, it is user-friendly. The interface is simple and easy to navigate. This makes it accessible even for those with limited accounting knowledge.

Second, Xero saves time. Automating routine tasks reduces the time spent on manual data entry. This allows business owners to focus on other important areas.

Third, Xero provides real-time updates. Business owners can access their financial data anytime, anywhere. This ensures they always have the most up-to-date information.

Lastly, Xero integrates with other business tools. This includes CRM systems and payment processors. This seamless integration helps streamline business operations.

Setting Up Xero

Setting up Xero for your small business is an essential step. This process ensures you can manage your finances efficiently. Xero offers a user-friendly interface. You can streamline accounting tasks and focus on growth. Let’s break down the steps.

Account Creation

Creating your Xero account is the first step. Visit the Xero website and click “Try Xero for free.” Enter your email address. Choose a strong password. Fill in basic information about your business. Confirm your email address. You’re ready to start.

Initial Configuration

After creating your account, begin the initial configuration. Add your business details. This includes your business name and address. Set up your financial year. Link your bank account. This allows Xero to import transactions automatically.

Next, set up your chart of accounts. This lists all the accounts you use for tracking income and expenses. Customize it to fit your business needs. Add users who will access the account. Assign roles based on their responsibilities.

Configure your invoice settings. Customize invoice templates with your logo. Set default payment terms. Add your payment details. This ensures clients can pay you easily. Set up tax rates. This is crucial for accurate financial reporting.

Finally, integrate Xero with other apps. This could be payroll software or CRM systems. These integrations can save time and reduce errors. Your Xero account is now ready for action.

Invoicing With Xero

Invoicing is a crucial part of any small business. With Xero, you can streamline your invoicing process, making it faster and more efficient. Xero provides a user-friendly platform that allows you to create, send, and track invoices with ease. This helps you save time and ensures you get paid promptly.

Creating Invoices

Creating invoices in Xero is simple. You can generate professional invoices in just a few clicks. Follow these steps:

- Log in to your Xero account.

- Navigate to the Sales menu.

- Select New Invoice.

- Fill in the customer details.

- Add the products or services provided.

- Set the due date.

- Review and click Send.

Xero offers customizable invoice templates. You can add your logo and choose from different layouts. This ensures your invoices look professional and match your brand.

Tracking Payments

Xero makes tracking payments easy. Once you send an invoice, you can monitor its status in real-time. Here are the steps to track payments:

- Go to the Sales menu.

- Select Invoices.

- View the status of each invoice.

The status can be:

| Status | Description |

|---|---|

| Draft | The invoice is being prepared. |

| Sent | The invoice has been sent to the customer. |

| Paid | The invoice has been fully paid. |

| Overdue | The invoice payment is past the due date. |

Xero also sends reminders for overdue invoices. This helps you stay on top of your receivables. You can set up automatic reminders to ensure you never miss a payment.

Using Xero for invoicing not only saves time but also ensures accuracy. This is vital for maintaining healthy cash flow in your small business.

Expense Management

Effective expense management is crucial for small businesses. It helps keep track of spending, ensures accurate financial records, and aids in making informed decisions. Xero, a popular accounting software, offers robust tools to simplify expense management.

Recording Expenses

With Xero, recording expenses is straightforward. You can quickly enter expenses directly into the system. This includes attaching receipts, categorizing costs, and noting payment methods. This process helps maintain accurate records and reduces the chance of errors.

Mobile access makes it even easier. Small business owners can record expenses on the go. Snap a picture of a receipt and upload it to Xero instantly. No need to keep track of paper receipts.

Expense Reports

Generating expense reports in Xero is simple. The software compiles all recorded expenses into comprehensive reports. These reports provide insights into spending patterns and highlight areas where costs can be reduced.

Customizable features allow for tailored reports. You can filter by categories, dates, or other criteria. This makes it easier to analyze specific aspects of your expenses. Sharing these reports with your accountant is also simple. Just export the report and send it over.

Bank Reconciliation

Bank reconciliation is a crucial task for small businesses. It ensures your bank transactions match with your accounting records. With Xero, this process becomes easier and more efficient. Small businesses can save time and reduce errors.

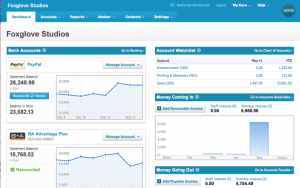

Linking Bank Accounts

To start, link your bank accounts to Xero. This enables automatic updates of your transactions. Go to the bank accounts section in Xero. Follow the prompts to connect your bank. You may need your bank login details. Once linked, Xero will import your bank transactions.

Automating Reconciliation

Automation in Xero helps streamline bank reconciliation. Xero matches your bank transactions with your accounting records. This reduces manual entry and errors. Review and confirm the matches suggested by Xero. If a match is incorrect, you can correct it easily. You can also create rules to automate repetitive transactions. This saves time and keeps your records accurate.

Financial Reporting

Financial reporting is crucial for small businesses. It helps track income, expenses, and overall financial health. With Xero, small businesses can easily generate and customize reports. This ensures informed decision-making and better financial management.

Generating Reports

Xero simplifies the process of generating financial reports. In a few clicks, you can create balance sheets, profit and loss statements, and cash flow reports. These reports give a clear picture of your business’s financial status. This helps in planning and budgeting for the future.

Xero’s interface is user-friendly. Even beginners can generate detailed reports without hassle. You can select the time period for the reports. This allows you to analyze financial data for specific months, quarters, or years.

Customizing Reports

Customizing reports in Xero is straightforward. You can tailor reports to fit your business needs. This means you can add or remove columns, change date ranges, and filter data. Customization ensures the reports highlight the most relevant information.

With custom reports, you can focus on key performance indicators. This helps in making strategic decisions. Xero also allows you to save customized report templates. This saves time and ensures consistency in your financial reporting.

Overall, Xero’s financial reporting features make it easier for small businesses to stay on top of their finances. Generate and customize reports effortlessly, and keep your business on the right track.

Payroll Management

Payroll management can be a challenging task for small businesses. Xero simplifies the process, making it easier to handle payroll duties. This section will guide you through the essential steps of managing payroll with Xero.

Setting Up Payroll

Start by setting up your payroll in Xero. First, enter your business details. This includes your business name, address, and tax information. Next, add your employees. You will need their personal details, tax information, and bank details. Make sure everything is correct to avoid future issues.

Configure your payroll calendar. Choose your pay period frequency. This can be weekly, bi-weekly, or monthly. Set the start and end dates for each pay period. This ensures that your employees are paid on time.

Managing Employee Payments

Managing employee payments in Xero is straightforward. Enter the hours worked by each employee. Xero will calculate their pay based on their hourly rate or salary. You can also add any bonuses or deductions. Ensure all details are accurate before processing payroll.

Once you have entered all details, approve the payroll. Xero will generate pay slips for each employee. You can email these pay slips directly to your employees. This keeps everything organized and ensures your employees are informed about their earnings.

Xero also allows you to manage payroll taxes. It calculates the taxes for you and generates reports. This helps you stay compliant with tax regulations. You can easily file these reports with the relevant authorities.

Credit: www.xero.com

Integrations And Add-ons

Small businesses need efficient tools to manage their operations. Xero offers integrations and add-ons that help streamline processes. These features extend Xero’s capabilities, making it more powerful. Discover how integrations and add-ons can benefit your business.

Popular Integrations

Xero integrates with many popular apps. These apps include PayPal, Stripe, and Square. Each integration offers unique benefits. PayPal helps with online payments. Stripe supports card payments. Square offers point-of-sale solutions. Integrations make transactions easier.

Another popular integration is Shopify. Shopify connects your online store with Xero. This syncs sales and inventory data. You save time and reduce errors. Other integrations include HubSpot for marketing and Trello for project management. Each app adds value to Xero.

Enhancing Functionality

Add-ons enhance Xero’s functionality. They offer specialized tools for different needs. For example, Receipt Bank helps with expense tracking. It scans and processes receipts. This saves you time on data entry. Gusto is another useful add-on. It simplifies payroll processing. You can manage paychecks and taxes with ease.

Another add-on is WorkflowMax. This tool improves project management. It tracks time and costs. It helps you stay on budget. Add-ons like these make Xero more powerful. They address specific business needs. Explore the options to find what works for you.

Tips And Best Practices

As a small business owner, utilizing Xero effectively can streamline your financial processes. To maximize the benefits of this accounting software, follow these tips and best practices. These guidelines will help you avoid common mistakes and optimize your usage.

Optimizing Usage

To get the most out of Xero, consider the following practices:

- Regularly Reconcile Transactions: Ensure your bank transactions match your Xero records. This keeps your accounts accurate.

- Automate Invoices: Use Xero to send automatic invoices. This saves time and ensures timely payments.

- Utilize Bank Feeds: Connect your bank account to Xero. This allows for real-time transaction updates.

- Set Up Reminders: Schedule reminders for upcoming payments and invoices. This helps you stay on top of your financial obligations.

- Use Xero Mobile App: Manage your finances on the go with Xero’s mobile app. This ensures you can access important information anytime.

Common Pitfalls

Avoid these common mistakes to ensure smooth operations:

- Ignoring Regular Updates: Always keep Xero updated. This ensures you have the latest features and security patches.

- Not Backing Up Data: Regularly back up your financial data. This prevents data loss in case of technical issues.

- Overlooking Training: Invest time in learning Xero’s features. Proper training can improve efficiency and reduce errors.

- Skipping Reconciliation: Never skip the reconciliation process. It’s essential for accurate financial records.

- Failing to Customize: Customize Xero to fit your business needs. Tailored settings can improve user experience.

By following these tips and best practices, small businesses can leverage Xero to its fullest potential. This will lead to more efficient financial management and business growth.

Frequently Asked Questions

What Is Xero For Small Businesses?

Xero is a cloud-based accounting software designed for small businesses. It simplifies bookkeeping, invoicing, and financial management.

How Does Xero Help Small Businesses?

Xero helps small businesses by automating accounting tasks. It offers real-time financial insights, invoicing, and expense tracking.

Is Xero Suitable For Startups?

Yes, Xero is suitable for startups. It provides essential tools for managing finances, invoicing, and expenses.

Can Xero Integrate With Other Business Tools?

Yes, Xero can integrate with various business tools. It connects with apps for payroll, CRM, and inventory management.

Conclusion

Xero offers a simple solution for small business accounting. It saves time and reduces errors. You can easily track expenses and manage invoices. With its user-friendly interface, anyone can use it. Xero also integrates with many other tools. This helps streamline your business processes.

Give Xero a try and see the difference. Your small business will benefit from its features. Keep your finances in check effortlessly.