Xero is a popular accounting software. Many businesses use it for financial management.

In this blog post, we dive into Xero reviews. We will explore what users think about its features, usability, and customer support. Whether you own a small business or a large enterprise, understanding Xero’s strengths and weaknesses can help you decide if it’s the right tool for your financial needs.

Stay with us to get a clear picture of how Xero performs in real-world scenarios and discover if it’s the right fit for your business. Let’s get started with our detailed look at Xero reviews.

Credit: www.softwareadvice.com

Key Features

Xero is a popular accounting software used by businesses around the world. Its key features make it a top choice for managing finances efficiently. This blog post explores the primary features that users love about Xero. Let’s dive into the details.

Cloud-based Accounting

Xero offers a robust cloud-based accounting system. This means users can access their financial data from anywhere at any time. This feature is especially useful for businesses with remote teams or multiple locations.

Some benefits of cloud-based accounting include:

- Real-time updates: Financial data is updated in real time, ensuring accuracy.

- Accessibility: Access your accounts from any device with an internet connection.

- Security: Data is stored securely in the cloud with regular backups.

Cloud-based accounting makes collaboration easier. Multiple users can work on the same data simultaneously. This reduces errors and speeds up processes.

Here’s a quick overview of the benefits:

| Benefit | Detail |

|---|---|

| Real-time updates | Ensures accuracy and timely information. |

| Accessibility | Work from anywhere with internet access. |

| Security | Data is safe with cloud storage and backups. |

Invoicing And Billing

Xero simplifies invoicing and billing for businesses. It offers customizable invoice templates that match your brand. You can send invoices directly from the platform. This speeds up the billing process and improves cash flow.

Key features include:

- Customizable templates: Design invoices that reflect your brand.

- Automated reminders: Send reminders for overdue invoices automatically.

- Online payments: Allow customers to pay invoices online, making it convenient for them.

Xero also tracks the status of invoices. You can see which ones are paid, unpaid, or overdue. This helps in managing your receivables better.

Here’s an example of how Xero’s invoicing benefits your business:

| Feature | Benefit |

|---|---|

| Customizable templates | Create professional invoices that match your brand. |

| Automated reminders | Reduce late payments with automatic reminders. |

| Online payments | Make it easy for customers to pay, improving cash flow. |

Bank Reconciliation

Xero makes bank reconciliation simple and efficient. It connects directly to your bank accounts and imports transactions automatically. This saves time and reduces errors compared to manual entry.

Benefits of Xero’s bank reconciliation include:

- Automatic transaction import: No need for manual data entry.

- Smart matching: Xero suggests matches for your transactions, speeding up the process.

- Accurate records: Keep your accounts accurate with up-to-date information.

With Xero, you can reconcile your bank transactions daily. This helps maintain accurate financial records and ensures you always know your cash position.

Here’s a quick look at the key benefits:

| Feature | Benefit |

|---|---|

| Automatic transaction import | Save time and reduce errors. |

| Smart matching | Speed up the reconciliation process. |

| Accurate records | Maintain up-to-date financial information. |

Reporting And Analytics

Xero provides powerful reporting and analytics tools. These tools help you understand your business’s financial health. With Xero, you can generate various reports, such as profit and loss statements, balance sheets, and cash flow reports.

Key features of Xero’s reporting and analytics include:

- Customizable reports: Tailor reports to meet your specific needs.

- Real-time data: Access up-to-date information for accurate decision-making.

- Visual dashboards: Get a quick overview of your financial status with visual dashboards.

Xero’s reporting tools are easy to use. You can generate reports with a few clicks. This helps in making informed business decisions quickly.

Here’s a summary of the benefits:

| Feature | Benefit |

|---|---|

| Customizable reports | Get the information you need in the format you prefer. |

| Real-time data | Make decisions based on the latest information. |

| Visual dashboards | Understand your financial health at a glance. |

User Experience

Xero is a popular accounting software used by businesses worldwide. In this blog post, we will look into Xero reviews, focusing on the user experience. This includes ease of use, customer support, and mobile accessibility.

Ease Of Use

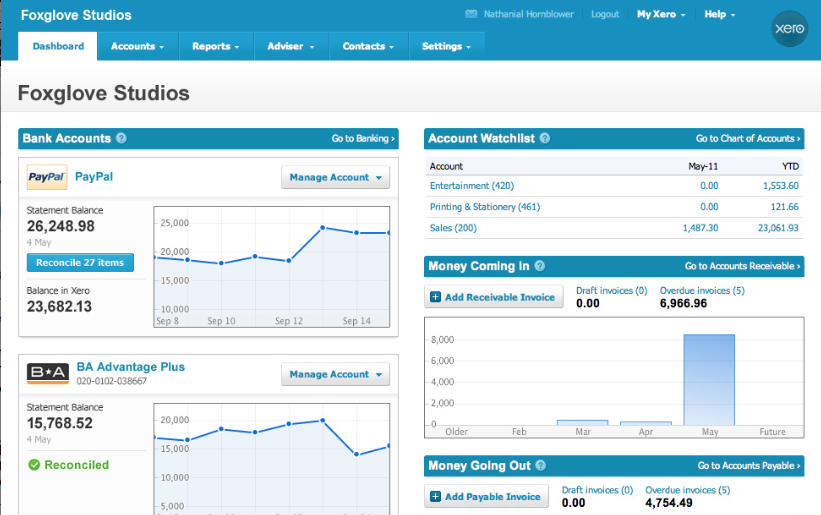

Xero is known for its intuitive and user-friendly interface. Many users find it easy to navigate and use. The dashboard is clean and well-organized, which helps users find the tools they need quickly.

Here are some key features that enhance Xero’s ease of use:

- Simple Navigation: The menu is straightforward, allowing users to access different sections with ease.

- Clear Layout: Information is displayed in a clear and concise manner, reducing the learning curve for new users.

- Helpful Tooltips: Xero provides helpful tooltips and guides to assist users in understanding various features.

Users often appreciate the following aspects:

| Feature | Description |

|---|---|

| Dashboard | Displays key financial information in a summarized view. |

| Bank Reconciliation | Allows for quick and easy matching of bank transactions. |

| Invoicing | Simple creation and tracking of invoices. |

Overall, Xero’s ease of use is a significant factor in its popularity among small business owners and accountants.

Customer Support

Customer support is a crucial aspect of any software service. Xero provides various support options to assist users with their needs. Their support includes:

- Email Support: Users can email Xero’s support team for assistance with any issues.

- Help Center: An extensive online help center with articles, guides, and tutorials.

- Community Forum: A platform where users can ask questions and share experiences.

Xero’s customer support team is known for being responsive and helpful. Users have reported positive experiences with the support they received. Here are some common user feedback points:

- Quick response times

- Knowledgeable support staff

- Comprehensive help articles

While Xero does not offer phone support, their email and online resources are often sufficient for resolving most issues. The community forum is a valuable resource, allowing users to learn from each other and find solutions to common problems.

Mobile Accessibility

Xero offers a robust mobile app that allows users to manage their accounting tasks on the go. The app is available for both iOS and Android devices, making it accessible to a wide range of users.

Key features of the Xero mobile app include:

- Real-time updates: Users can view real-time financial information and stay updated on their business finances.

- Invoicing: Create and send invoices directly from the app.

- Expense tracking: Capture receipts and track expenses on the go.

- Bank reconciliation: Match bank transactions and keep accounts up to date.

The app is designed to be user-friendly and mirrors the desktop experience. Users can perform many of the same tasks they can on the desktop version. This includes checking cash flow, reconciling bank transactions, and managing invoices.

Overall, Xero’s mobile accessibility ensures that users can manage their accounting tasks anytime, anywhere. This flexibility is particularly beneficial for business owners who need to stay on top of their finances while on the move.

Integration

Xero is a popular accounting software known for its robust features and user-friendly interface. One of the key aspects that set Xero apart is its ability to integrate seamlessly with various tools and platforms. This integration capability enhances the overall functionality, making it a preferred choice for businesses of all sizes. In this section, we’ll delve into the integration features of Xero, focusing on third-party apps and API capabilities.

Third-party Apps

Xero’s integration with third-party apps is one of its standout features. It connects with over 800 apps, allowing users to extend the software’s functionality to meet specific business needs. This vast ecosystem of apps covers various categories, including inventory management, payroll, CRM, and more.

Here are some notable categories and examples:

- Inventory Management: DEAR Inventory, TradeGecko

- Payroll: Gusto, Hubdoc

- CRM: Salesforce, HubSpot

- E-commerce: Shopify, WooCommerce

These integrations ensure that businesses can manage all aspects of their operations from one central platform. For instance, integrating Xero with a CRM like Salesforce allows for automatic syncing of customer data, reducing manual entry and errors.

Additionally, the Xero App Marketplace makes it easy to find and connect these apps. Users can browse by category or search for specific apps, read reviews, and see ratings. This transparency helps in making informed decisions about which apps to integrate.

Api Capabilities

Xero’s API capabilities provide even more flexibility for businesses. The API (Application Programming Interface) allows developers to create custom integrations tailored to unique business requirements. This is particularly useful for businesses with specific needs that can’t be met by existing third-party apps.

Key features of Xero’s API include:

- Comprehensive Documentation: Detailed guides and documentation make it easy for developers to understand and utilize the API.

- Extensive Endpoints: Access to various endpoints including invoices, contacts, and bank transactions.

- Real-Time Data: The API ensures that data is updated in real-time, providing accurate and up-to-date information.

With these capabilities, businesses can integrate Xero with their in-house systems or other external platforms. For example, a company can develop a custom reporting tool that pulls data directly from Xero, providing tailored insights and analytics.

Moreover, Xero’s API supports multiple programming languages, making it accessible to a wide range of developers. This encourages innovation and allows businesses to leverage the full potential of Xero’s accounting software.

Credit: anyasreviews.com

Pricing

Xero is a popular accounting software that many businesses use. It offers various features to help manage finances. One important aspect to consider is its pricing. Understanding the cost can help you decide if Xero is the right choice for your business. Let’s explore the details of Xero’s pricing, including subscription tiers and additional costs.

Subscription Tiers

Xero provides three main subscription plans. Each plan offers different features and benefits. Here are the details:

- Starter Plan: This plan costs $20 per month. It includes basic features like sending invoices, entering bills, and reconciling bank transactions. It is perfect for small businesses with simple accounting needs.

- Standard Plan: Priced at $30 per month, this plan offers more features. It includes everything in the Starter Plan, plus additional benefits like bulk reconciliation and handling multiple currencies.

- Premium Plan: The most comprehensive plan costs $40 per month. It includes all the features of the Standard Plan, with added benefits such as project tracking and expense management.

Here is a table to summarize the subscription tiers:

| Plan | Monthly Cost | Features |

|---|---|---|

| Starter | $20 | Basic invoicing, bill entry, bank reconciliation |

| Standard | $30 | Bulk reconciliation, multiple currencies |

| Premium | $40 | Project tracking, expense management |

Additional Costs

Besides the monthly subscription, there might be extra costs. These can depend on your business needs:

- Payroll: If you need to manage payroll, Xero offers this as an add-on service. The cost starts at $10 per month for up to 5 employees. For more than 5 employees, it costs an additional $4 per employee.

- Extra Users: Xero allows a limited number of users in each plan. Adding more users can increase your monthly cost. Each additional user can cost around $2 per month.

- Advanced Reporting: Some businesses may need advanced reporting features. These features might come at an extra cost, depending on the complexity and requirements.

Here is a breakdown of additional costs:

| Service | Cost |

|---|---|

| Payroll (up to 5 employees) | $10 per month |

| Payroll (each additional employee) | $4 per employee |

| Extra Users | $2 per user per month |

| Advanced Reporting | Varies |

Considering these additional costs can help you budget better. It ensures you get the most out of Xero without unexpected expenses.

Pros And Cons

Xero is a popular accounting software used by many small and medium-sized businesses. It offers a range of features that can help streamline financial management. However, like any tool, it comes with both advantages and limitations. Understanding these pros and cons can help you decide if Xero is the right choice for your business.

Advantages Of Xero

Xero offers several benefits that make it an attractive option for businesses. Here are some of the key advantages:

- Cloud-Based Access: Xero is cloud-based, which means you can access your financial data from anywhere with an internet connection. This is particularly useful for businesses with remote teams.

- Ease of Use: The user-friendly interface makes it easy for non-accountants to navigate and use the software. It simplifies complex accounting tasks.

- Integration: Xero integrates with over 800 third-party apps, including payment platforms, CRM systems, and inventory management tools. This flexibility allows you to customize the software to fit your business needs.

- Automated Invoicing: Xero allows you to automate invoicing, which saves time and reduces the risk of human error. You can set up recurring invoices and reminders for late payments.

- Real-Time Data: Xero provides real-time updates on your financial status. This helps you make informed decisions quickly.

Here is a table summarizing some of the main advantages:

| Feature | Advantage |

|---|---|

| Cloud-Based | Access from anywhere |

| Ease of Use | User-friendly interface |

| Integration | Connects with 800+ apps |

| Automated Invoicing | Saves time |

| Real-Time Data | Informed decisions |

Limitations Of Xero

While Xero has many advantages, there are also some limitations to be aware of:

- Cost: Xero can be expensive for small businesses, especially when you need advanced features. There is a monthly subscription fee that varies based on the plan you choose.

- Learning Curve: Although Xero is user-friendly, there is still a learning curve, particularly for those new to accounting software. It may take time to get used to all the features.

- Customer Support: Some users have reported that Xero’s customer support can be slow. Getting help quickly might be challenging during busy periods.

- Limited Payroll Features: Xero’s payroll features are not as robust as those offered by dedicated payroll software. This could be a drawback for businesses with complex payroll needs.

- Offline Access: Since Xero is cloud-based, you need an internet connection to access your data. This can be a limitation if you are in an area with poor connectivity.

Here is a table summarizing some of the main limitations:

| Feature | Limitation |

|---|---|

| Cost | Can be expensive |

| Learning Curve | Initial time investment |

| Customer Support | Potentially slow |

| Payroll Features | Limited functionality |

| Offline Access | Requires internet |

Security

Xero is a popular accounting software known for its ease of use and robust features. But how secure is it? Many users are concerned about the security of their sensitive financial data. In this section, we’ll dive into the security measures Xero employs to protect your information.

Data Encryption

Xero uses advanced data encryption to keep your information secure. Data encryption ensures that your data is converted into a code to prevent unauthorized access. Here are some key points about Xero’s data encryption:

- 256-bit SSL encryption: This is the same level of security used by banks and financial institutions.

- Encryption at rest: Your data is encrypted not only during transmission but also when stored on Xero’s servers.

- Regular security audits: Xero conducts frequent security audits to identify and fix potential vulnerabilities.

Encryption is a critical part of Xero’s security strategy. It ensures that even if data is intercepted, it cannot be read or used by unauthorized parties. This level of security provides peace of mind for users, knowing their financial information is safe.

Additionally, Xero uses secure data centers that comply with industry standards. These data centers are equipped with:

- Advanced firewalls

- Intrusion detection systems

- 24/7 monitoring

With these measures, Xero ensures that your data is protected from both digital and physical threats.

Access Control

Access control is another vital aspect of Xero’s security. It ensures that only authorized users can access your account. Here are some of the access control features Xero offers:

- Two-factor authentication (2FA): This adds an extra layer of security by requiring a second form of verification, such as a mobile app or SMS code.

- User permissions: You can set different access levels for users, ensuring that employees only see the information they need.

- Activity tracking: Xero logs all user activities, allowing you to monitor who accessed your account and what changes were made.

With these features, you have control over who can access your data and what actions they can perform. This minimizes the risk of unauthorized access and potential data breaches.

Xero also supports single sign-on (SSO) for businesses using identity providers like Google or Microsoft. This simplifies the login process while maintaining security. SSO reduces password fatigue and improves overall security by centralizing access control.

In summary, Xero’s access control measures provide a robust framework for protecting your data. They ensure that only authorized personnel can access sensitive information, reducing the risk of unauthorized access.

Frequently Asked Questions

What Is Xero Used For?

Xero is an online accounting software designed for small businesses. It helps manage invoices, bank reconciliation, and payroll.

Is Xero Good For Small Businesses?

Yes, Xero is highly recommended for small businesses. It offers comprehensive features and is user-friendly.

How Much Does Xero Cost?

Xero offers different pricing plans starting from $11 per month. The cost varies based on features.

Can Xero Handle Payroll?

Yes, Xero can handle payroll. It simplifies employee payments and tax calculations efficiently.

Conclusion

Xero offers great tools for managing your business finances efficiently. Its features suit both small and medium-sized businesses. The user-friendly interface makes accounting tasks easier. Customer support is responsive and helpful. You can try the free trial to see if it fits your needs.

Overall, Xero is a solid choice for business accounting. Consider exploring its features to improve your financial management.